In this blog series, we’ve looked at the latest entry in the only longitudinal survey of underwriters in North America. The study, which is run in partnership with Accenture and The Institutes, provides vital context for tracking the trajectory of underwriting, which is the heart of any insurance carrier’s business.

And our most recent data, collected in 2021, has not been encouraging.

Which makes this post refreshing as we turn our attention to what underwriters told us about the impact of technology on their work. It’s not uniformly positive, but the silver linings are much easier to spot in this data.

The impact of technology on core underwriting

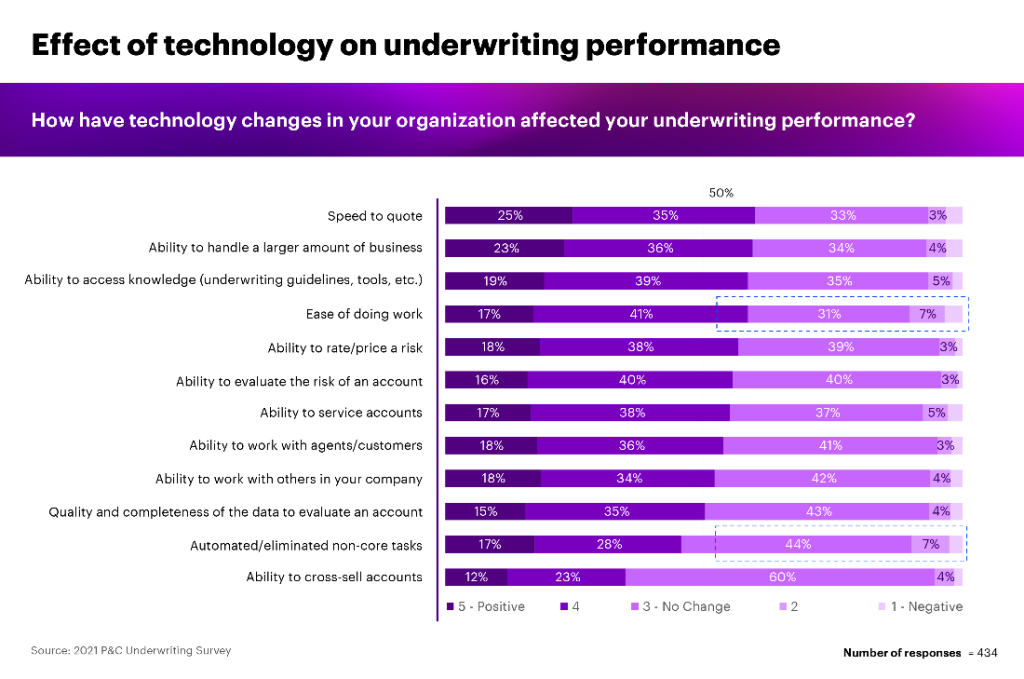

The good news jumps right out of the data: overall, carriers say that technology investments in their organizations have had a positive impact on quoting, selling, evaluating risk and pricing, and servicing accounts.

This figure shows that more than half of all survey respondents said that technology changes in their organization have had a positive impact on most parts of underwriting in their organization.

The five areas of underwriting most improved by technology were, in order:

- Speed to produce a quote

- Ability to handle larger amounts of business

- Ability to access knowledge

- Ease of doing work

- Ability to rate and price risk

Overall, this is some much-needed good news in the survey’s data.

But note the categories toward the bottom of the figure: just 45% of underwriters told us that technology has automated or eliminated the non-core underwriting tasks they perform. A plurality (44%) say technology has had no impact here, and 11% say it has been negative.

This finding should be viewed in context with the rest of the survey. Recall that it also revealed that the average underwriter today spends on non-core underwriting tasks.

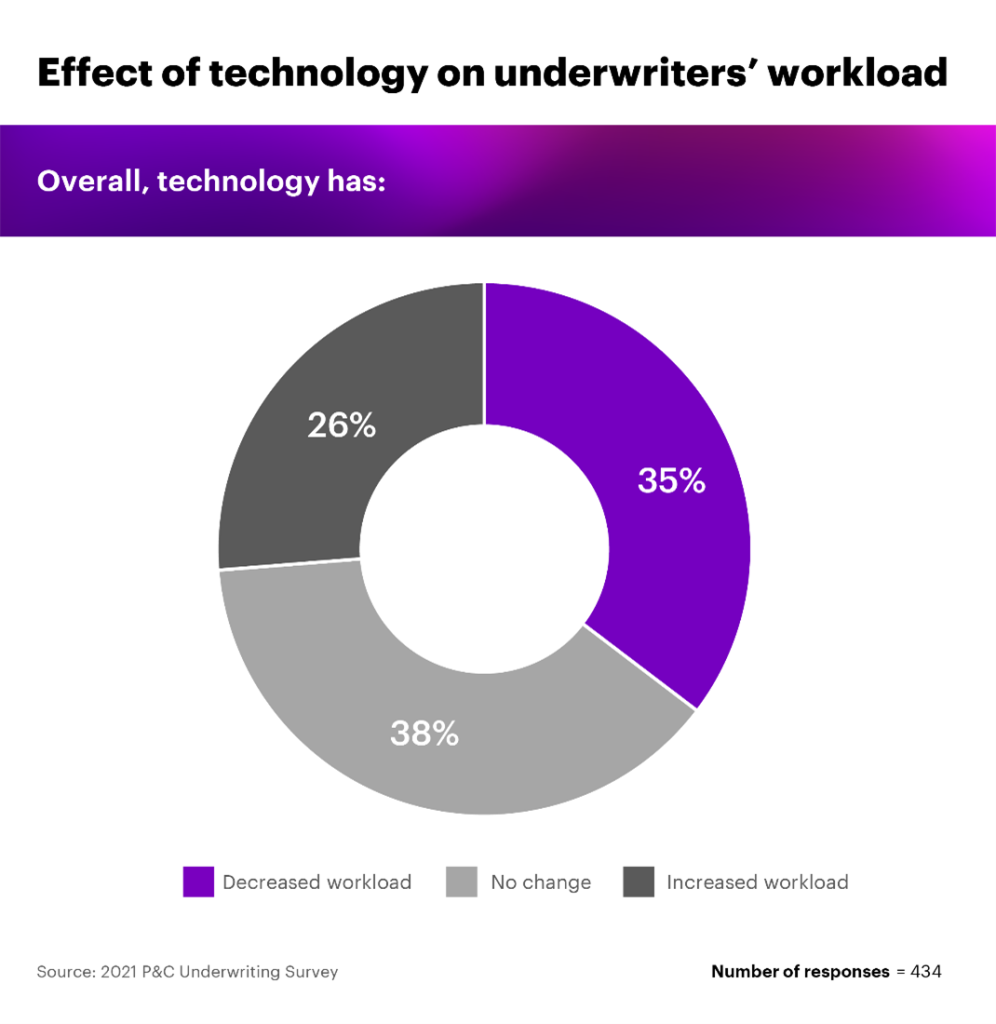

This is also reflected elsewhere in the survey data. For example, we asked underwriters what impact technology has had on their workload.

Just 35% said that it had decreased their workload, while 64% said their workload was unchanged or had increased due to technology.

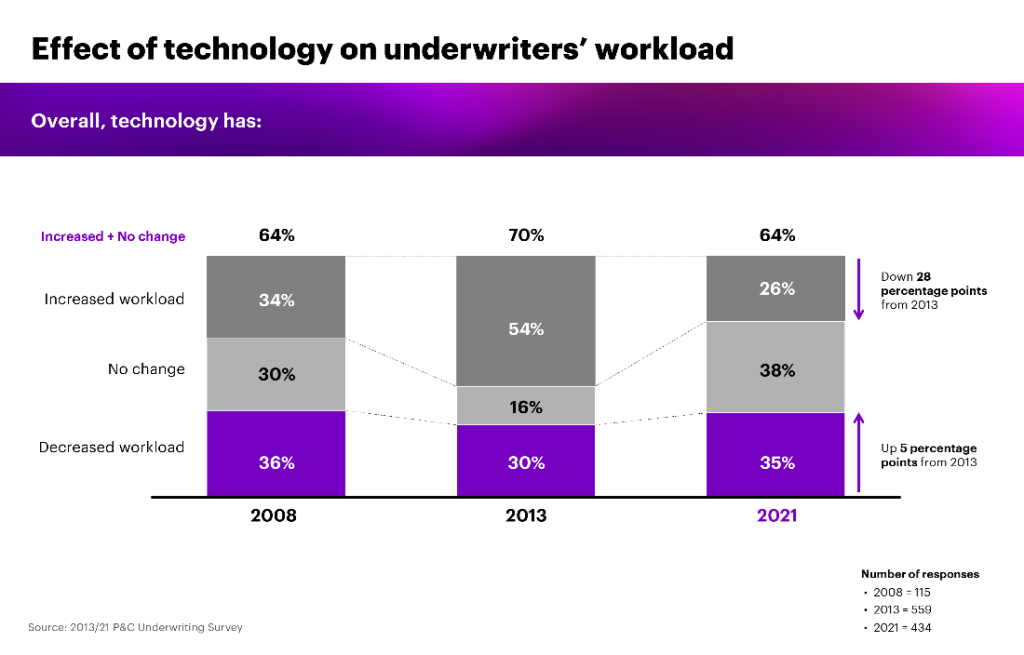

However, when we look at this data in a historical context, another silver lining emerges.

The portion of underwriters whose workloads are increasing due to technology is down 28 percentage points from the 2013 survey. In fact, the 26% who say technology is increasing the amount of work they do is the lowest portion we’ve seen across the 13 years covered by our data.

Breaking out of the hamster wheel

To me, the last decade of tech investment in underwriting is a bit like a hamster running on a wheel—a lot of energy has been expended, but we haven’t really gone anywhere.

Or at least not as far as we need to go. It’s true that most carriers have made significant investments in their underwriting tools. As I’ve written previously, in Making the digital leap in underwriting, the first generation of these tools focused on providing rating systems and core policy management, while the second generation was made to complement the first with workflow solutions.

However, most underwriting environments are still scattered and disaggregated. The time required to use each separate system or transfer information between them means that more often than not, a new tool takes up at least as much time as it is supposed to save for underwriters.

For example, one carrier we worked with not long ago did a tally of all the digital solutions that an underwriter was theoretically supposed to use in a single workday. The count came to 92.

Splitting the underwriting workflow into dozens of tools like this is why, as the survey data suggests, carriers are not seeing the returns they expect from their underwriting investments.

To be clear, I don’t mean that these investments have been futile or that creating these digital tools does not unlock important exciting new insights and abilities for underwriters—quite the opposite. The tools and systems that underwriters have at their disposal now are nothing less than astonishing. For example, they can shine a light on “dark data” to drive better underwriting decisions, among other things.

But, as our research suggests, too often these don’t make the difference that they should for underwriting workflows and for the carrier’s business as a whole. Insurance organizations that reach high ambition levels for the human experience are all too rare in the industry today.

To change that, we’ll need to see underwriters use what I call the third generation of digital tools in underwriting. This new generation will connect the dozens of tools currently at the disposal of underwriters into one cohesive platform that integrates seamlessly into the workflow.

And the really exciting side of this? Signs of this trend are already beginning to emerge around the industry. We’ll cover it in more detail on this blog in the future.

In the meantime, the next post in this series will look at what our longitudinal survey revealed about talent management in underwriting.

Get the latest insurance industry insights, news, and research delivered straight to your inbox.

Disclaimer: This content is provided for general information purposes and is not intended to be used in place of consultation with our professional advisors.

#Tech #improving #underwritingbut #youd #Insurance #Blog