Artificial intelligence has been around since the 1950s, but over the last several years the business potential of AI has expanded dramatically. We now live in a world where big data and powerful computational capabilities allow AI to flourish. Companies—including insurance carriers—are investing in establishing data lakes, optimizing for cloud-based operations and activating AI for targeted analytics.

Insurers are seeing tangible results from their current AI initiatives. Our AI maturity research shows that carriers’ share of cost savings generated through AI more than doubled between 2018 and 2021. We predict that share will triple by 2024. Furthermore, insurers have been fairly satisfied with the return on their AI investments. Fifty two percent of insurance companies said the return on their AI initiatives exceeded their expectations, while only 3% said the return didn’t meet expectations.

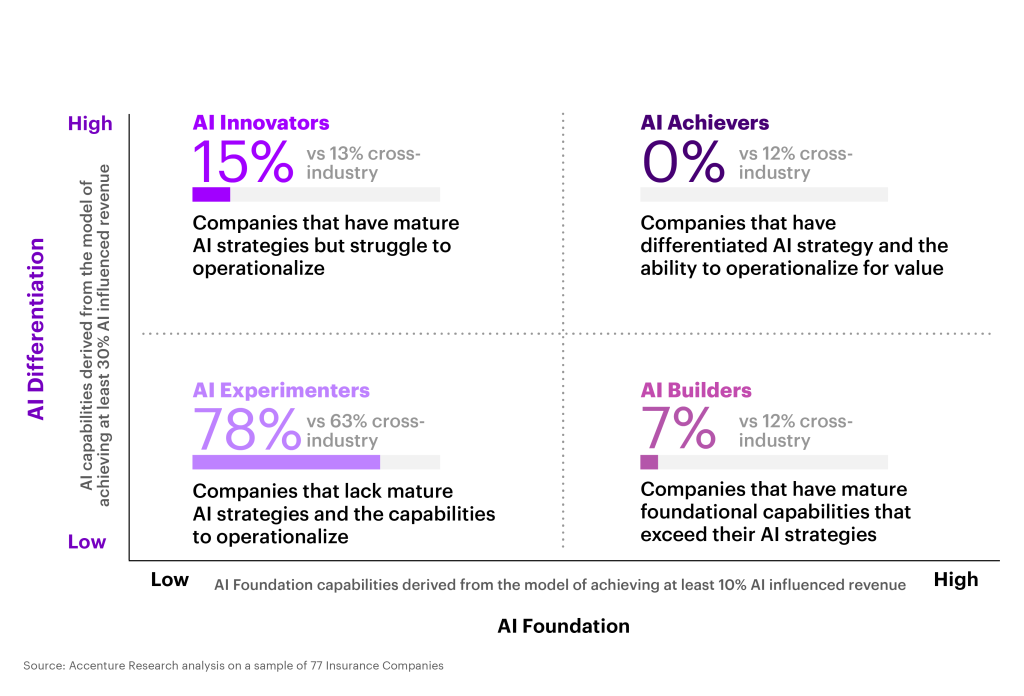

However, insurers are leaving value on the table. In our analysis of 77 insurance companies, we found that none of them were AI Achievers, which we define as companies that have a differentiated AI strategy and have operationalized AI to execute on that strategy. In fact, most insurance companies are in the AI Experimenter category, representing those who have the least-mature AI strategies and lack the capability to operationalize AI.

Insurers can move into the Achiever category to realize greater value by leveraging AI to power total enterprise reinvention. This includes employing AI in organization-wide decision-making and integrating AI into every part of the business—from business process optimization to delivering reimagined products, services and experiences to customers.

Carriers looking to gain momentum with their AI investments can find opportunities in the front office and build out their next phase of growth. Our study explored three key front office use cases that I’ll be diving into in this post: customer experience, product and service development, and sales and marketing.

Customer experience intelligence and journey automation

When it comes to customer experience optimization, insurers are beginning to make progress compared to other industries—yet they are still in the early stages of AI activation.

Many insurers have invested in developing a single view of the customer and have been able to understand what products customers own, if they have recently made a claim or whether they have received a quote for another product.

While some insurers are starting to gain a better understanding of the interactions they have with a given customer, most insurers struggle to connect the customer journey across multiple channels and touchpoints. Far fewer are able to use those insights to understand the breakpoints in that experience and address them systematically.

Though many insurers have invested in customer relationship management (CRM) platforms to share customer insights across the enterprise, few have layered in AI to use those insights to orchestrate highly personalized customer experiences that span marketing, sales, service and claims. Leading CRM vendors are integrating AI capabilities into their platforms, making it easier to embed out-of-the-box AI models into any workflow. Choosing such a technology is a major opportunity to create omnichannel experiences and build a truly holistic view of each customer.

When it comes to automating parts of the customer journey, conversational AI remains a largely untapped opportunity for the insurance industry as a whole. Those that are creating self-contained conversational experiences that satisfy customers’ needs—rather than simply answering FAQs or pointing customers to where they can get help—are generating higher levels of satisfaction with significant customer service cost savings and reduced reliance on a challenging labor market.

New product and service development

Recently, Accenture found that 88% of executives think their customers’ needs are changing faster than their businesses can keep up with. Factors like climate change and economic uncertainty are forcing customers to adapt to circumstances that are out of their control, moving through territory as they try to make the decisions that are best for them. Our research revealed a need for companies to shift from focusing on customer as consumer to developing a nuanced understanding of the customer as a multifaceted human being with complex and often contradictory desires.

This shift from customer-centricity to an approach we’ve coined “life-centricity” is especially relevant for carriers as they develop products. AI can help carriers widen their understanding of customer behavior and move outside of cookie-cutter customer profiles with data insights. It can help them build offerings that can be tailored to the needs and habits of customers as they move through their life, seamlessly recommending or upgrading individuals’ products to respond to events like the purchase of a new home or providing coverage as climate change reshapes natural disaster risk.

There are plenty of opportunities for insurers to create new products and services that use AI to realize more value and deliver enhanced experiences. We’re already seeing many carriers implementing AI in their auto insurance products to assess driver behavior and offer pay-as-you-drive policies.

As IoT and wearable technology improves, carriers will be able to use AI to gain an even deeper understanding of customer behaviors, meeting their needs and predicting what their needs might be in the future. With a deeper understanding of the customer, carriers can build products with a greater level of personalization, at scale.

My colleague Jim Bramblet has explored a few ways AI can provide another layer of protection for customers while gathering data about their risk profile and needs. One of the examples he discusses is an IoT-connected factory floor, where AI stops and starts machines as workers pass, notifies team members about parts that need maintenance and enables them to view potential hazards via AR glasses.

Sales and marketing intelligence, recommendations and process automation

Finally, carriers can leverage AI to enhance their sales and marketing performance. Throughout the marketing and sales funnel, carriers can implement AI to surface the most relevant recommendations to customers and address their questions in the moment. For example, UK business insurance company Tapoly uses AI at every customer touchpoint to offer tailored commercial line insurance products to their target market of micro-SMEs and freelancers. They also employ AI to optimize pricing and risk assessment based on customer data.

When customers want to speak directly to a live person, AI can streamline the human-to-human experience and increase the likelihood that the customer achieves the outcome they’re looking for. Agents will benefit from more data and insights at their fingertips, which means that they can seize upsell and cross-sell opportunities in the moment. Agents can rely on an AI assistant to surface the most relevant information in real time and make recommendations as they speak to a prospect.

Sompo has also partnered with AI CRM firm Vymo to build AI-enabled proactive sales coaching technology to improve the service that their team provides. Ping An has developed a similar solution that serves up relevant customer data as well as real-time coaching assistance that enhances agent performance.

How insurers can become AI Achievers

In our recent report, The Art of AI Maturity, we identified five key areas companies need to invest in if they want to realize the full potential of AI and seize the value that’s at stake.

- Ensure that leadership champions AI as a strategic priority for the entire organization. When it comes to transformation, everyone is a stakeholder. Leaders must ensure that their teams understand the value AI brings to their everyday tasks, and to the overarching business goals.

- Invest heavily in talent to get more from AI investments. Innovation comes from employing a diverse group of people to solve problems in unique and meaningful ways.

- Industrialize AI tools and teams to create an “AI core.” To scale AI, carriers need to create repeatable processes that create a strong foundation for increased innovation as time goes on.

- Use AI responsibly, from the start. AI ethics and governance needs to be at the center of every AI initiative as carriers scale. Today, only 35% of consumers trust how AI is being implemented by organizations. To retain customers, carriers must demonstrate transparency and minimize bias.

- Plan long- and short-term investments. There is no finish line when it comes to AI strategy and innovation. Customer needs will continue to evolve, as will AI capabilities. Those who plan ahead will stay ahead as the need to adapt increases.

AI’s potential in insurance is far from being fully realized, but carriers that take the initiative to build a strong AI program today will see a strong return from those investments. I would love to discuss how you can better leverage AI in your front office, so please don’t hesitate to get in touch with me.

Transforming claims and underwriting with AI: AI has emerged as the critical differentiator in the insurance industry when applied in tandem with humans.

LEARN MORE

Get the latest insurance industry insights, news, and research delivered straight to your inbox.

Disclaimer: This content is provided for general information purposes and is not intended to be used in place of consultation with our professional advisors.

Disclaimer: This document refers to marks owned by third parties. All such third-party marks are the property of their respective owners. No sponsorship, endorsement or approval of this content by the owners of such marks is intended, expressed or implied.

#insurers #win #race #maturity #Insurance #Blog