The Sarbanes-Oxley Act of 2002 (SOX)—named for its chief sponsors, former Sen. Paul Sarbanes (D–Md.) and former Rep. Mike Oxley (R–Ohio)—was intended to restore trust in the transparency of publicly traded companies after the collapses of WorldCom and Enron Corp. revealed that their auditors had certified financial reports that overstated the firms’ assets and massively understated their liabilities.

But, of course, “transparency” isn’t quite the same thing as prudential safety and soundness. In the insurance space, more specifically, transparency doesn’t necessarily equal solvency.

A new paper from Martin Grace of Temple University and Juan Zhang at Eastern Kentucky University looks at how property and liability insurers have responded to the enhanced disclosure and attestation requirements, both of SOX itself and of new auditing rules subsequently adopted by state insurance regulators. The latter were closely modeled on SOX, but also applied to nonpublic insurers, primarily mutuals.

They reach a counterintuitive conclusion: more transparent disclosures have made insurers less cautious in their reserving practices.

Grace and Zhang focus on the impact that annual internal controls reports required both by Section 404 of SOX and the National Association of Insurance Commissioners’ (NAIC) Model Audit Rule (MAR) have had on insurers’ likelihood to adopt “conditionally conservative” accounting practices, in which unrealized losses are recognized more quickly than unrealized gains. Because both Section 404 and MAR create penalties for financial irregularities that can apply personally to chief executive officers and chief financial officers, it would be reasonable to assume that the rules would make regulated firms more likely to be conservative in their financial reporting.

Indeed, that’s what Gerald Lobo of the University of Houston and Jian Zhou of the University of Hawaiʻi at Mānoa found in a 2010 paper in the Journal of Accounting, Auditing and Finance. Looking at a set of public companies that are listed both in Canada and the United States, they found that firms with U.S. arms, and therefore subject to SOX, became much more likely to reduce the amount of “discretionary” accruals they reported, with the effect most pronounced among firms that were most aggressive about recognizing such accruals—which can be easily manipulated—in the pre-SOX period.

But while Lobo and Zhou’s research didn’t focus on an any particular sector and used industrywide and market-based indicators to judge the degree to which conditional conservatism was practiced, Grace and Zhang were able to use firm-specific information about accruals—specifically, property and liability insurers’ loss-development disclosures, as reported in Schedule P, Part 2 of the NAIC statutory annual statement.

Under the NAIC’s Statutory Accounting Principles, insurers must make annual updates to their estimates of incurred losses from a given accident year for each of their past 10 development years. Because not all claims are reported during the coverage period and reported claims may take years to settle, loss-reserve estimates will become more accurate over time as claims are paid and more information about the amount of “true” losses becomes known.

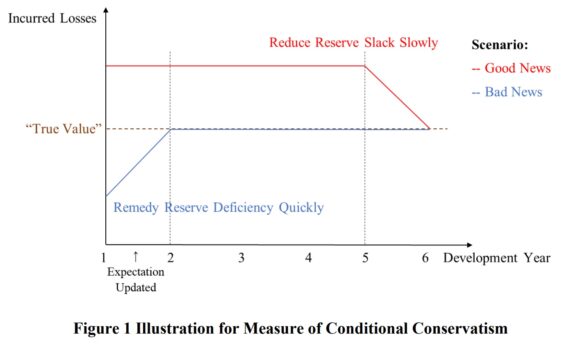

As this information becomes available, insurers can be surprised by “good news” that they initially over-reserved for a given accident year or by “bad news” that they have a reserve deficiency. Under conditionally conservative accounting, they would move to address deficiencies immediately, but wait to release superfluous “slack” reserves until the apparent “good news” can be verified—i.e., when all losses are paid off.

But Grace and Zhang find the effect of enhanced financial transparency rules has been that insurers use less conditional conservatism, releasing reserves more quickly on “good news” and being less quick to take needed reserves on “bad news.” They find a particularly strong effect since the NAIC promulgated the Model Audit Rule, which was adopted in nearly all states in 2010, except for Alaska, which adopted it in 2011, and New Hampshire, which adopted it in 2017. Puerto Rico and the District of Columbia likewise adopted the rule in 2011.

The authors put forward the theory that what’s driving this effect is that the safe harbor that SOX Section 404 and MAR grant to financial managers may reduce the incentive they previously had to adopt conservative reserving practices.

“In other words, the upfront reporting requirements can help insurers convince the state commissioners that their accounting is proper; as a result, insurers do not have to react to expected losses as quickly as they did in the absence of the new rules,” Grace and Zhang write. “Insurers may consider the compliance with SOX Section 404 and MAR and conditional conservatism strategy substitutes to deal with the state commissioners and rating agencies.”

In one sense, Grace and Zhang’s findings suggest that the accounting reforms of the 2000s did precisely what they were designed to do: make firms’ financial reporting more accurate and transparent. When insurers practice conditional conservatism, the result will tend to be to inflate their reserves and therefore distort the value of the firm.

But those distortions will also tend to enhance solvency by providing a buffer against future unexpected losses—particularly catastrophes or major lawsuits. In getting swept up in the post-Enron reforms, state insurance regulators may have too closely copied an auditing model that was designed to yield more accurate valuations of public companies, rather than one fit to purpose for their role as prudential regulators.

The most important insurance news,in your inbox every business day.

Get the insurance industry’s trusted newsletter

#SarbanesOxley #Insurance #Riskier