This post is part of a series sponsored by SWBC.

In the past two years, real estate investors have experienced a global pandemic, a nation-wide housing boom, outbound migration from urban centers, inflation reaching 40-year highs, and steep interest rate hikes that are now beginning to cool the housing market.

Taken all together, this has been one of the most disruptive periods the rental real estate market has seen since the housing market crash of 2008. Today, your real estate investor clients are focused on protecting their bottom lines while still growing their portfolios.

As your clients’ trusted insurance broker, is critical to understand the changing market and the challenges that come with it so you can provide the most valuable support when they come to you with questions or requests for referrals.

In this article, I’d like to share valuable insights from SWBC’s Chief Economist, Blake Hastings, on the current state of the real estate market and the outlook for investors in 2023.

Housing Costs, Inflation, and Interest Rates in Q4 2022

Housing costs, which make up about 30% of inflation indices, continue to remain elevated and are likely to for at least another year.

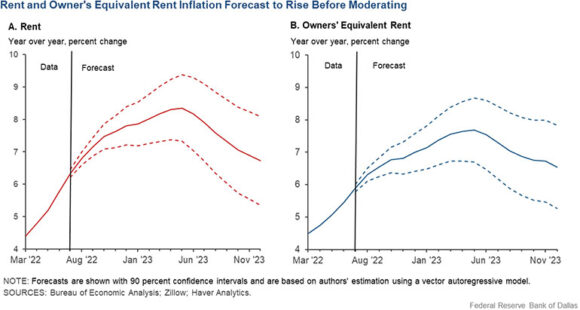

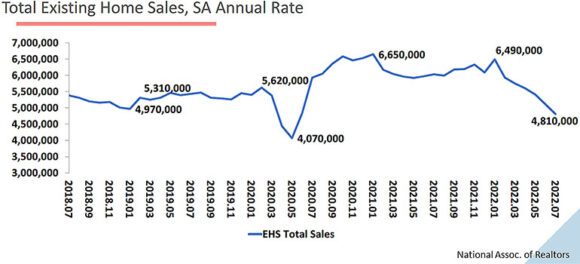

Due to technical reasons around how inflation is calculated, surging house prices feed into rents and related housing cost measures with a significant delay of 12 to 18 months.

With home prices seeming to have peaked in September and recorded a slightly negative number nationwide, we may still be a year away from the peaking of rents. The chart on the following page shows their estimate for the rent and owners’ equivalent rent portion of the consumer price index.

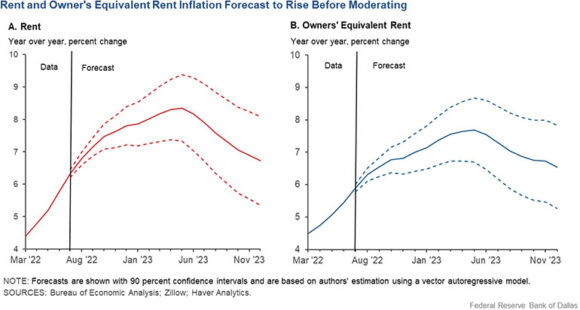

Meanwhile, interest rates for all CREs are rising:

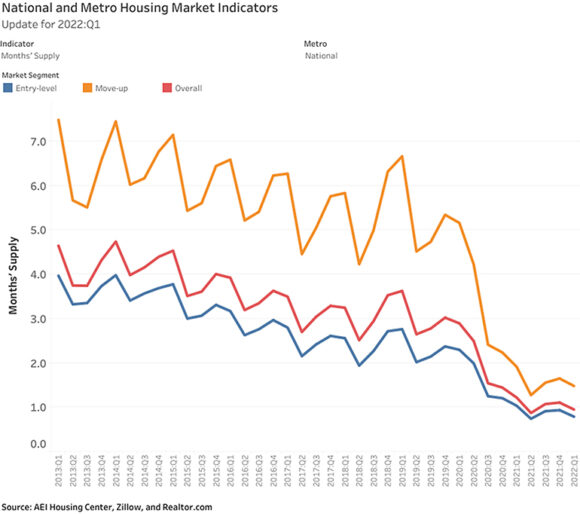

Housing Sector Supply and Demand in Q4 2022

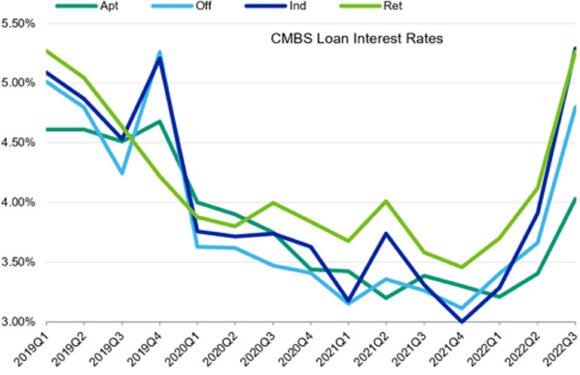

Both supply and demand are cooling off in the housing sector. Home prices are expected to stay stable.

2023 U.S. Real Estate Outlook

Residential Single Family

- This sector of real estate will continue to be weak with some deterioration in price of around 5-7%.

- Demand and supply are both declining which should limit price declines.

Multifamily

- This sector will see rental rates slow, but still grow 4-5%.

- Cap rates are still declining despite higher interest rates, but trend should reverse in Q4 2022 or Q1 2023.

- Higher interest and cap rates will slow new development into 2023 and 2024.

Industrial (Warehouse)

- This real estate sector will hold up well as continued move to just-in-case from just-in-time inventory management will hold up demand.

- Rents will be flat to maybe up 1-2%.

- Higher interest and cap rates will slow new construction.

Retail

- This sector will likely slow. As retail sales continued to be challenged by inflation, marginal retailers will struggle

- Rents should be flat to down 3-4%.

- New development will be very soft.

Office

- This sector continues to be the biggest question mark. Work-from-home and hybrid arrangements will likely lower demand by 15% per worker in 2023.

- Rents will likely be around 5-7%.

- New development will be challenged for the next several years.

When your clients partner with SWBC for their Real Estate Investor Insurance needs, they’ll gain premier service from a company that has been serving this market for nearly 30 years. We stand by our reputation in providing a consultative approach to address your REI clients’ needs and recognize any gaps in existing insurance coverage they may already have while keeping cost top of mind.

Visit our website to learn more.

The most important insurance news,in your inbox every business day.

Get the insurance industry’s trusted newsletter

#Real #Estate #Investor #Clients #Expect