If you’re considering a career in the insurance industry or simply want to know what an insurance underwriter does, you’ve come to the right place. In this article, we will explain the important contributions these professionals make in the insurance scheme of things. We will also discuss what it takes to become one and how the job differs from other roles in the industry.

An insurance underwriter is an industry professional tasked to determine whether an insurer can provide coverage to individuals, families, or businesses by evaluating the risks involved in insuring them. Underwriters work closely with other insurance professionals – such as actuaries, brokers, and risk managers – to craft ways on how insurance companies can strike a balance between providing competitive rates to attract and retain clients and maintaining profitability.

Insurance underwriters typically specialize in one insurance line. The most common of which are:

- General insurance – includes home, auto, pet insurance, and travel insurance

- Life insurance – assesses premiums for death benefits; can include disability and critical illness insurance

- Health insurance – evaluates costs for a range of health plans, including those not under the Affordable Care Act (ACA)

- Commercial insurance – covers business-related policies

- Reinsurance – where a portion of the risk is shared with another insurer

While the primary role of an insurance underwriter is to assess clients’ risk exposure to determine if they can be accepted for coverage, the scope of their roles goes beyond this.

The Bureau of Labor Statistics (BLS) has listed several duties and responsibilities that an insurance underwriter must perform. These include:

- Analyzing the information each client provides on their insurance applications

- Determining the risk involved in insuring clients or the likelihood that they will make a claim

- Screening applicants based on set criteria – which vary depending on the insurance line – including age, credit rating, driving history, gender, and health status

- Using automated software to determine the risk of insuring applicants and reviewing recommendations from these platforms

- Obtaining additional information about clients by contacting field representatives, medical personnel, and other relevant sources

- Determining appropriate premium amounts, and terms and conditions of coverage

- Ensuring premiums are competitive and accounts remain profitable

- Keeping detailed and accurate records of policies underwritten and decisions made

Insurance companies often prefer candidates with a bachelor’s degree to fill their insurance underwriter vacancies. Most insurers, however, also consider those with significant insurance-related work experience, even if they possess only an associate’s degree or a high school diploma. Insurance-related certifications can likewise help candidates land the job.

Here are the standard qualifications insurers are looking for when searching for potential insurance underwriters.

Insurance underwriter education

A bachelor’s degree in actuarial science, business, economics, finance, or mathematics provides a solid foundation for those looking to start a career as an insurance underwriter. They can also take insurance underwriting courses and other related programs at accredited colleges. Some universities offer master’s degrees in insurance risk management, which can open opportunities for career advancement.

Insurance underwriter training

Entry-level underwriters typically work under the supervision of a senior insurance writer for a certain period – usually 12 months – until they can perform their roles with minimal instruction. Some insurance companies also offer training programs to help new hires excel at their jobs.

Insurance underwriter certifications

Insurance underwriters are expected to obtain certification as they progress through their careers, especially if they are targeting a senior underwriter role or an underwriter management position. Each line offers a variety of underwriting certifications that keep insurance professionals updated about new products, regulatory changes, and the latest innovations.

Here are some examples of certifications that an insurance underwriter can take to help advance their careers:

Chartered Property and Casualty Underwriter (CPCU) certification

Designed for professionals with at least two years of insurance underwriting experience, this consists of four core courses, three concentration courses, one elective course, and an ethics course. Underwriters must also pass an examination to be eligible for certification.

Chartered Life Underwriter (CLU) certification

Offered by the American College of Financial Systems, this 18-month program is designed for those with at least three years of experience in the insurance industry. The curriculum consists of five core courses and three elective courses that cover a range of topics for life insurance professionals, including:

- Life insurance planning

- Life insurance law

- Real estate planning

- Planning for business owners and professionals

Candidates must likewise pass a test to earn a certificate.

Life Underwriter Training Council Fellow (LUTCF) certification:

This three-course program covers the basics of life insurance, risk management, investment products, and practice management. It is offered by the National Association of Insurance and Financial Advisors (NAIFA). Candidates are required to pass an exam to obtain certification.

Underwriters specializing in health insurance can complete the Registered Health Underwriter (RHU) certification from The American College, while business insurance underwriters can earn an Associate in Commercial Underwriting (AU) certification from the Insurance Institute of America.

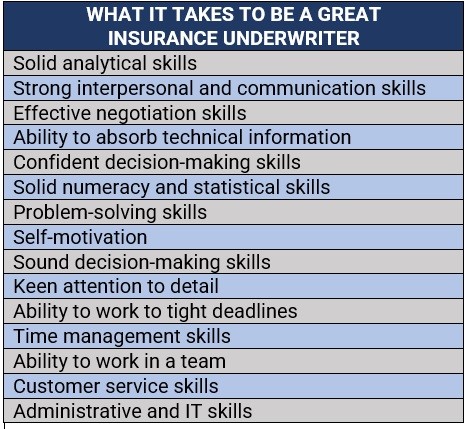

The five most essential skills that an insurance underwriter should possess to excel in their roles are:

- Analytical skills: The ability to evaluate large sums of information and accurately strike a balance between risk and caution.

- Decision-making skills: The ability to sift through a variety of factors to determine whether an applicant should be approved for coverage, and if so, how much premiums should be and what the terms and conditions for coverage are.

- Attention to detail: The ability to maintain sharp focus when reviewing insurance applications as each item has an impact on the coverage decision.

- Interpersonal and communication skills: The ability to relate to and communicate well with others as the job entails dealing with clients and other industry professionals.

- Math skills: Superior numeracy skills as the role also involves a lot of calculations to determine premiums and probability of losses.

Most insurance underwriters work in the office full-time for the following businesses and organizations:

- Major insurance companies with a wide range of insurance products

- Smaller insurance providers specializing in one type of cover

- Life assurance companies

- Reinsurance companies

- Health insurers

- Banks and other financial institutions

- Credit agencies

According to the most recent data from the BLS, insurance underwriters based in the US earn an average of $76,390 annually, with the lowest 10% earning less than $47,330 and the top 10% earning more than $126,380.

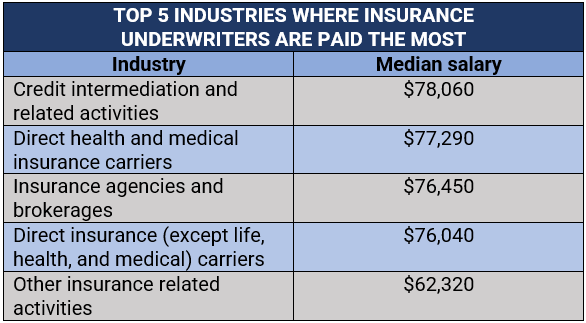

These are the top five industries where the median salaries for an insurance underwriter are the highest.

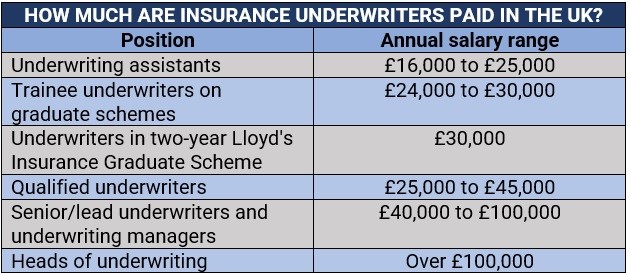

In the UK, the salary range for the different levels of insurance underwriters are as follows:

In Canada, the average insurance underwriter salary is CA$62,500 per year or CA$32.05 per hour. The salaries for entry-level positions start at $48,750 per year, while most experienced workers can earn up to CA$96,412 annually.

Find out which insurance jobs pay the most in our latest rankings.

Insurance underwriters and insurance brokers both play key roles in the insurance industry, helping clients access various types of coverage. These professionals, however, perform vastly different duties.

As discussed above, an insurance underwriter works for an insurance company, assessing the risks potential clients pose and deciding if they can be approved for coverage. Underwriters also use a range of metrics to determine premium pricing and the terms and conditions of coverage, bearing in mind the company’s ability to maintain profit.

The primary role of an insurance broker, meanwhile, is that of a middleperson. They act as intermediaries between the buyers and the insurance companies, with the goal of assisting individuals and businesses in finding policies that cater to their unique needs. These industry professionals can work independently or as part of an insurance brokerage firm.

So, while an insurance underwriter puts the interest of the insurance company first, an insurance broker serves the customers, helping them find the coverage that suits their needs and budget.

Does becoming an insurance broker sound like a better fit for you? You can learn more about what it takes to become a successful insurance broker by checking out this article.

Insurance underwriting can be a challenging job. Underwriters are under constant pressure to attract and retain clients while helping insurers maintain profitability – two goals that often come into conflict with each other, especially in a highly competitive market. But with the right mix of technical ability and soft skills, industry professionals can excel in this role.

The table below lists the different attributes an insurance underwriter should have to become successful in this field.

If working for an insurer is not for you and you would rather start your own insurance company, this handy guide can give you a good head start.

Do you think being an insurance underwriter is a good career option? Tell us why or why not in the comments section below.

#Insurance #underwriters